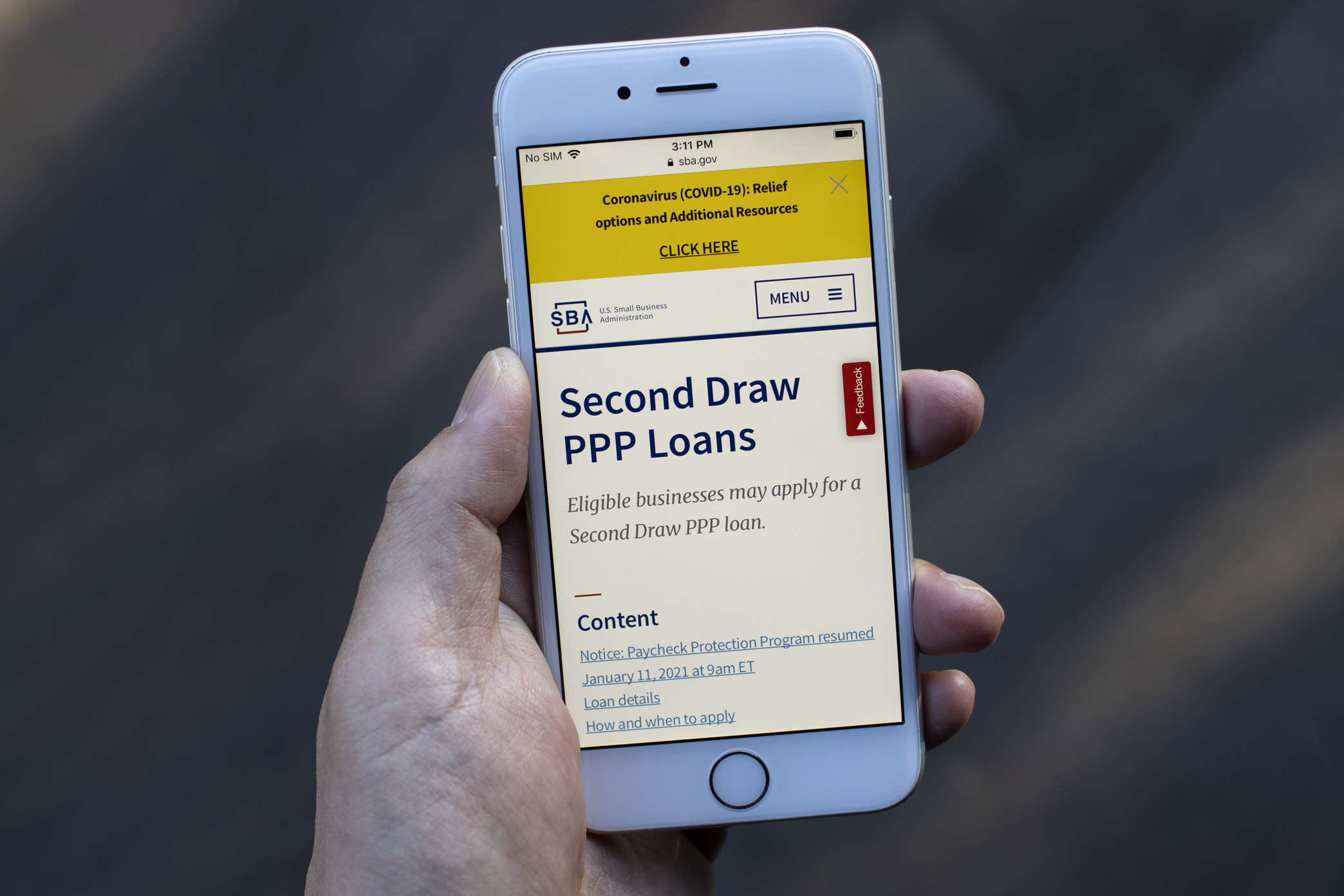

UPDATE: Second draw PPP Loan Details

Late Yesterday Evening the SBA and Treasury released Interim Final Rules on the second draw Paycheck Protection Program (PPP) loan Program.

TERMS

In general, the PPP Second Draw is subject to the same terms and conditions as the first Draw PPP Loans:

- The guarantee percentage is 100 percent

- No collateral will be required

- No personal guarantees will be required

- The interest rate will be 100 basis points or one percent, calculated on a non-compounding, non-adjustable basis

- The maturity is five years

- Loans will be processed through Lenders, such as Banks and Credit Unions

\ ELIGIBILITY

- 300 or fewer employees and

- experienced a revenue reduction in 2020 relative to 2019 of 25%

- Second Draw PPP Loan may only be made to an eligible borrower that

- has received a First Draw PPP Loan, and

- has used, or will use, the full amount of the First Draw PPP Loan on or before the expected date on which the Second Draw PPP Loan is disbursed to the borrower

\ CALCULATIONS

- Revenue reduction is calculated by comparing the quarterly gross receipts for one quarter in 2020 with the gross receipts for the corresponding quarter in 2019.

- This reduction can be documented with quarterly financial statements, bank statements, or annual tax returns (where 2020 is 25% less than 2019)

- Loans of Less than $150,000 must retain this documentation but are not required to submit

- First Draw PPP Loan Forgiveness received in 2020 is not included for purposes of this calculation

- Loan Amount is calculated by taking 2.5 times the average monthly payroll ($2 Million Maximum) for one of the following:

- The 12 months preceding the loan application,

- All 12 months of 2020, or

- All 12 months of 2019 as was calculated for the first draw

- If applying with the same lender as was used for the first Draw PPP, for loan amounts less than $150,000, no documentation will be required to be submitted

- NAICS codes beginning with 72 (accommodation and food services sector) can use 3.5 times their average monthly payroll

This information will also be made available here. Please contact me should you have any questions.