IRS TO ISSUE AUTOMATIC UNEMPLOYMENT-RELATED REFUNDS

The IRS has said that it will take steps this spring and summer to automatically correct returns that were filed prior to the American Rescue Plan Act form.

The IRS has said that it will take steps this spring and summer to automatically correct returns that were filed prior to the American Rescue Plan Act form.

Yesterday the U.S. Senate passed legislation that would extend the time businesses have to apply for a Paycheck Protection Program (PPP) loan to May 31st, 2021.

Beginning the week of April 6th, 2021 Borrowers will be able to apply for the SBA’s Economic Injury Disaster Loan (EIDL) funding for up to 24 months of economic injury with a new maximum loan amount of $500,000.

Yesterday, the SBA issued guidance on the relationship between the Shuttered Venue Operations Grant (SVOG) and the Paycheck Protection Program (PPP).

Today, the Biden Administration has announced several changes to the existing PPP Loan Program.

Yesterday, Governor Evers signed a bill that would allow the Wisconsin Department of Revenue to follow IRS ruling that allow for the exemption of forgiven PPP loans from taxation.

We have noted that in some 2nd round Paycheck Protection Program (PPP2) applications for partnerships filers, are needing to be updated due to the self-employment calculation for the partners amount to be used in the payroll calculation.

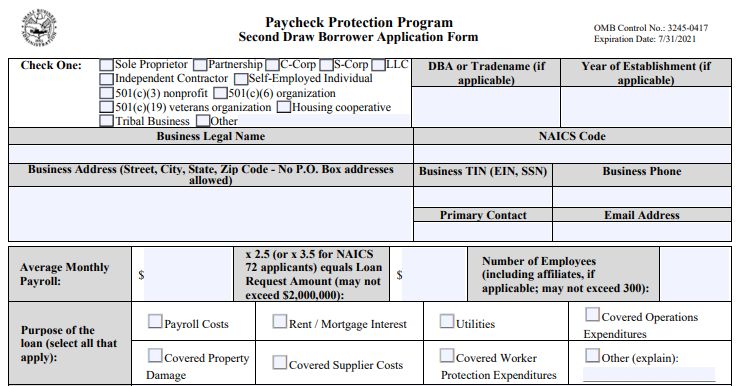

Late Friday, the SBA released forms for the application of the Second Round of Paycheck Protection Program (PPP2).

Late Yesterday Evening the SBA and Treasury released Interim Final Rules on the second draw Paycheck Protection Program (PPP) loan Program.

On Thursday, 564 trade associations led by the Association of General Contractors (AGC) asked Congress to pass legislation reversing a ruling made by the IRS, disallowing the deduction of expenses related to the forgiveness of Paycheck Protection Program Loans (PPP).

Go to home page

Go to home page

12600 W Burleigh Rd.

Brookfield, Wisconsin 53005