UPDATE: PPP2 and Partnership Income

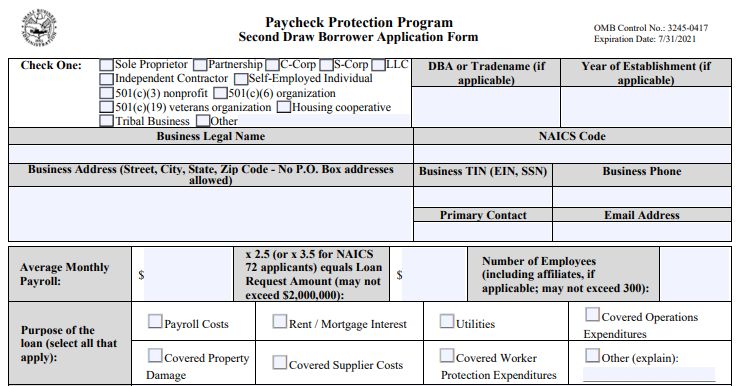

We have noted that in some 2nd round Paycheck Protection Program (PPP2) applications for partnerships filers, are needing to be updated due to the self-employment calculation for the partners amount to be used in the payroll calculation.

Please be aware that the Gross self-employment income amount needs to be multiplied by 0.9235 to calculate the eligible amount for the partner to be used in the wage calculation.

Please see attached for detailed instructions from the SBA regarding Partners’ self-employment income.

Please reach out to Andrew Dengel at (920) 921-3356 or [email protected] should you have any questions or would like assistance applying.